Kucoin, sitting in seventh place on our rankings of the world’s best cryptocurrency exchanges, takes on Bitfinex, just above them in sixth. With their rankings being so incredibly close, is it the case that the winner of Kucoin vs Bitfinex will come down to user preference? Actually, yes, so we’ve called this one a tie.

It’s time to dig deeper and explore these exchanges’ most critical aspects to determine why we couldn’t call a clear winner between them.

Kucoin’s Trading Fees

Both Kucoin and Bitfinex can boast a native utility token; in Kucoin’s case, Kucoin Shares, though you’ll see it referred to as KCS. What do these utility tokens do? Well, they are another type of cryptocurrency, which, if you buy enough of them, can unlock discounts on your trading fees. Beginners, this doesn’t affect you unless you’re planning on trading more than 50 BTC per month.

For our readers who are trading at a more advanced level, you may notice in the table below that Kucoin is one of the few exchanges that offers trading fee rebates (see LV 8 onwards) for big traders. When we say significant, we are talking at least $600m worth of trades per month (at current Bitcoin value).

While those mega-trade numbers might seem overwhelming, they indicate that the platform is safe for institutional traders to use. That’s objectively good news for all users, meaning that security and legitimacy are high priorities for the operational teams.

Withdrawing cryptocurrencies from Kucoin brings about a different charge depending on the crypto.

Trading Costs On Bitfinex

Beginners, you don’t need to worry too much about Bitfinex’s trading fees unless you’re planning on trading over $500,000 per month, at which point you would unlock specific discounts. The fees you do need to know about are the 0.1% fee for makers and 0.2% for takers.

Makers provide liquidity to an exchange by placing an order different from the market price, whereas a taker makes an immediate trade at the current price.

Like Kucoin, Bitfinex also has a native utility token called LEO. Holding enough LEO can give traders a 25% discount on their trading fees.

Winner: Kucoin.

Bitfinex vs Kucoin Sign up and KYC experience

Getting started on Kucoin

Follow these steps to begin your trading experience with Kucoin:

1. Head over to Kucoin.com and click ‘Sign Up’ in the top-right corner.

2. Provide your email address and a secure password.

3. Head to your email client to find an email containing an activation link. Click the link.

4. You’ll now be asked to connect to Google Authenticator, a 2-Factor Authentication tool that provides increased security and can stop your account from being compromised.

5. Now your account is made, you need to add some funds. Hover over the avatar in the top corner and select ‘KYC Verification.’ You can’t add funds until this verification is complete.

6. Next, choose ‘Individual Verification’ and provide your name, country of residency, an ID document, and your ID number; this will satisfy KYC1 and KYC2 obligations.

7. You must now wait for verification.

Kucoin has three different tiers of verification, labelled as ‘Unverified’, ‘KYC1’ and ‘KYC2’. The trading limits for unverified and KYC1 users are almost identical, so new users are encouraged to do KYC2 (advanced verification).

Note: Users in the US can trade up to 2 BTC per day with an unverified account but will not perform KYC checks. All crypto-to-crypto trades made by US citizens are taxable and must be documented.

Getting Started On Bitfinex

Setting up on Bitfinex is done in the same vein as Kucoin. Let’s walk you through it:

1. Visit Bitfinex.com and click ‘Open Account’ on the homepage.

2. Provide a username, email address, and a secure password for your profile. Accept the terms and conditions.

3. Next, head to your email client and click the verification link in the email from Bitfinex, which will open a new tab/window.

4. In this new tab/window, log in with the details you provided in step two.

5. Once logged in, you will have the option to verify your ID, which in turn will allow you to add fiat currency to your account. You will be asked to provide:

1. Name

2. Age

3. Contact details

4. Residential address

5. Two forms of Government ID (submitted via mobile or webcam)

6. A selfie holding your ID

7. A bank statement

8. Proof of your residential address (like a rental contract)

After submitting these details, you may need to wait up to 3 days to receive confirmation, in which time you can consider some additional security details, such as:

1. 2-Factor Authentication

2. Blocking withdrawals from a new IP address

3. A ‘withdrawal confirmation phrase’

4. PGP mail encryption

Scroll down to the ‘Deposit Methods’ section to learn how to get funds into your account upon verification.

Note: Users in the US are not allowed to trade directly or indirectly on Bitfinex.

Winner: Tie.

Ease of Use & Feel of Bitfinex vs Kucoin Website/App

Kucoin – Community Driven

We are pleased to tell you that Kucoin is one of the best options for beginners, offering a web and mobile platform with style and substance. The cool designs balance out with a trading apparatus that is logical, fast, and well-ordered. On top of that, their 0.1% trading fees make them pretty cheap by comparison with other cryptocurrency exchanges.

Beyond looks, function, and low fees, we are equally impressed by their opportunities to reward their users. Besides discounted trading fees with KCS, they also offer a crypto-mining scheme, a bonus scheme for splitting dividends among KCS holders, a referral scheme with potentially lucrative results, and a soft-staking program.

Bitfinex, highly legitimate

One of Bitfinex’s Italian-American founding partnerships’ intentions was to create an exchange that would solve the problem that most exchanges back in 2012 were suffering from — liquidity.

Back then, not enough people were trading cryptocurrency to create high liquidity and stable trades. Still, Bitfinex managed it, and their pioneering work set an excellent early standard in the industry.

Being a founding member of the crypto-world also made them a primary target for hackers, so they have had to work hard to develop and reinforce the security that can encourage beginners, advanced traders, and institutions to use their services.

A particular feature that is quite rare in the cryptocurrency exchange marketplace is a Paper Trading Account — a demo account that allows you to practice trading on Bitfinex with imaginary funds, learning how the platform works, and whether your strategies are effective. The learning process shouldn’t take too long to achieve, as Bitfinex is straightforward.

Despite having the feeling that it leans more towards professionals, which is, of course, more profitable for them, it’s also accessible for beginners on both the web platform and the app.

Winner: Kucoin.

Deposit Methods

Can You Deposit Fiat Currency Into Kucoin?

Kucoin is a prolific broker and an exchange. Having positioned themselves as a very friendly option for beginners, they know that their profit margins are much better when selling crypto directly to new users than allowing them to deposit fiat currency.

When using Kucoin and trying to make a deposit, a window will pop-up asking, ‘Do you have digital assets?’ If you do, you can transfer them in from an external web wallet, but if you don’t, your only option is to buy some directly from Kucoin. Scroll down to ‘Instant Buy Options’ to find out what to do next.

Bitfinex’s Big Deposit Requirements

When comparing Bitfinex vs Kucoin deposit requirements, Bitfinex is similar to Kucoin because they would prefer you to buy cryptocurrency directly from them. Still, they differ in that they do have an option for users to deposit fiat currency.

It comes with one pretty hefty caveat, the minimum deposit. For some readers, a minimum deposit of 10,000 USD, EUR, or GBP, or 1m JPY, is not a problem, but for many hesitant novices who want to dip their toes in the pool of cryptocurrency and the Blockchain, these sums are too high.

If those figures are not out of your range, you’ll be pleased to know that the wire transaction fee is a measly 0.1% (plus a €0.60 flat fee per wire), considerably lower than credit card fees will be.

As is the case with almost every single cryptocurrency exchange, depositing crypto is free; find your wallet address within the account and make the transfer from your external wallet.

Winner: Bitfinex (somehow).

Instant Buy Options (Buying with credit or debit card)

Kucoin

While Kucoin might not allow for deposits, they have a lot of options for instant purchases, such as:

1. Bank transfer

2. Sepa

3. Paypal

4. Interac

5. POLi

6. iDEAL

7. Credit card

8. Simplex

9. Banxa

10. WeChat Pay

11. Alipay

12. PayMIR

You’ll want to make sure Kucoin supports your local currency before trying to purchase crypto. Fortunately, through Kucoin Fast Buy, users can buy Bitcoin, Ethereum, and Tether instantly with the following currencies:

1. Australian Dollar

2. Bangladeshi Taka

3. Indonesian Rupiah

4. Canadian Dollar

5. US Dollar

6. Philippine Peso

7. Indian Rupee

8. Vietnamese Dong

Bitfinex

So, if you haven’t got ten grand sitting around to play with and invest into cryptocurrencies, which is completely understandable, you’ll be glad to know that Bitfinex allows verified users to make instant purchases of the following cryptocurrencies, with a minimum order of just $25:

1. Bitcoin (BTC)

2. Tether (USDT)

3. Tezos (XTZ)

4. Tron (TRX)

5. Litecoin (LTC)

6. Zcash (ZEC)

7. Dash (DASH)

8. Algorand

9. Basic Attention Token (BAT)

10. Ethereum (ETH)

11. Tether Gold (XAUt)

12. Selected other ERC-20 altcoins

Note that the fees will vary depending on the circumstances of each purchase.

Winner: Kucoin.

Trading Experience

Is Kucoin Smooth For Trading?

We are impressed with the trading experience on Kucoin, with over 500 market pairs hosted on a smooth, clean, and well-designed platform. Despite more market pairs, their trading volume and liquidity are much lower than Bitfinex, which might not win them any favors for institutional customers, but doesn’t impact beginners.

The web trading interface itself shouldn’t take too long to get used to but isn’t as intuitive as Bitfinex. The layout might benefit from being reorganized left-to-right, as it currently feels a little bit backward.

The app is a handy tool for crypto-newbies making their formative steps in this sector.

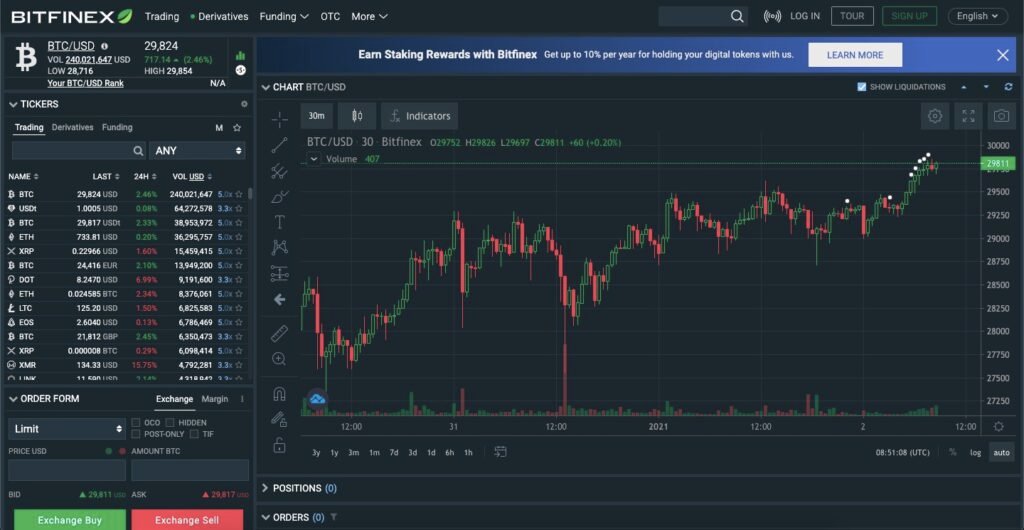

Bitfinex, Doing The Basics Well

As we’ve stated before, Bitfinex has a more corporate or professional vibe than Kucoin — choose to see that as a good thing or a bad thing. What it does mean, though, is it needs to be absolutely efficient and completely legit, so while it offers a lot of technical features you might never use, it does the basics impressively well. The app is even more straightforward to use than the web view, a simplified replica that allows for reliable trading on the go.

One feature that Bitfinex offers is the ability to choose your market pairing from your wallet or dashboard, leading you all the way to the trading view and leaving you to add in the order details and click trade. If, when you’re in the order form, you want to buy crypto immediately at the market price, an option called Market Order allows you to do that (hey, presto, you’re now a ‘taker’).

Winner: Tie.

Reputation & Security

Kucoin, Recovery Specialists

Kucoin’s reputation, especially regarding security, is highly subjective. It was quite shocking when they were hacked back in September 2020, losing $30m of Bitcoin, $86m of Stellar, and other coins totaling $147m. With $281m in the wind, Kucoin got to work, enacting all security protocols, partnerships, and insurance policies.

Thanks to the transaction history of the theft on the Blockchain, $160m was sent back to them by other exchanges within days. Bitfinex and Tether collectively froze $33m of USDT. After three months of maximum effort, $235m worth of crypto was back in their accounts, $13m was reportedly withdrawn through decentralized protocols, and $25m remained unaccounted for.

Naturally, a lot of traders left the platform. More than 60% of the altcoins listed on Kucoin said they had been negatively affected by the hack, with funds not only stolen from supporters but now sat in the accounts of those with bad intentions.

The Kucoin hack potentially reflects poorly, but the recovery effort and success in getting back around 80% of hacked funds puts them in a good light in our books.

Bitfinex, Negotiating With The Enemy?

Bitfinex was the victim of one of the biggest hacks ever, with 120,000 BTC taken. This is now worth several billion dollars, and it was an event that some could not overcome and so never returned. Other professionals and institutions saw the event, and Bitfinex’s security-bolstering response indicated that they would not let a major hack happen again.

The worst part of the hacking ordeal is that Bitfinex offered the hackers 25% of the stolen funds if they returned all of the Bitcoin. The hackers didn’t bite, but it left a sour taste in many people’s mouths in an event akin to negotiating with the kidnapper.

Winner: Tie.

Conclusions:

This is perhaps the closest comparison we’ve ever done, so it’s not fair to give the win to either exchange. Let’s put it this way, if you’re in the US, you can’t use Bitfinex at all, so that’s easy. If you’re a total beginner, Kucoin is friendlier. If you want to do all of your tradings within an app, Bitfinex’s app is better. If you plan on making big-value trades, Kucoin’s fees are lower. If you are a professional or an institution looking for a solid trading platform, go for Bitfinex. Good luck out there!