Getting inflation under control still appears to be the Fed’s top concern, judging by Chair Jerome Powell’s latest statement. This spells bad news for the stock market and cryptocurrency markets, where selling pressure is expected to persist.

A lot of people think the bottom is about to drop out from under us again. But Cathy’s wood isn’t one of them. Cathie Wood and the rest of the Ark Invest team just made some bold statements in their monthly market update. Thus, the purpose of this piece is to examine the most important lessons.

We will examine Kryptos, which is currently struggling between three important levels of support, and listen to Cathie’s one-minute market assessment of where we stand right now. After that, we’ll wrap up with watching the merging, one of the most anticipated crypto events of all time. Not only that, but the options and futures market is exhibiting some pretty unusual behavior as of late.

First of all, the world economy is in shambles, inflation is out of control, and the stock market has crashed, but Cathie Wood thinks we may be near the bottom.

First, let’s listen to her summarize the market in 60 seconds.

Cathie;

“From the middle of June to around the middle of August, the equities markets were quite calm. And now we’re putting that rally to the test. Let’s spend a little time discussing that.

We believe a bottom is in sight. I get how aggravating that is. And I’ve been around the block a few times; these are bear markets, defined as declines of 20% or more from their high points. And the instances where things should be working out the best just seem so frustrating. But bear with me as I go through this routine procedure.

And I want to give you a sense of the tug of war out there and why we think we’ve hit bottom. How mounting data suggests we’re entering a deflationary period. Wow, Cathy Wood sure is making some bold assertions.”

First, she thinks we’ve hit bottom already, so there won’t be any more devastating crashes.

She is advocating for a deflationary climate despite widespread inflation at multiyear highs. Now, let’s move on to the next topic: the epic struggle taking place in the cryptocurrency market around three crucial levels of support. Then, there’s something quite intriguing happening with the long-term holders, as revealed by a chain analysis.

3 Key Levels

First, we’ll take a look at a popular chart, the 200-week moving average, which depicts the yearly trend. And this Green line, representing the 200-week moving average, has been a great moment to accumulate historically. And what is the number on the table at the moment? It’s $22,680. And now Bitcoin has broken through a crucial support level.

And in general, if you are dollar cost averaging or investing a lump sum below this amount, you will likely have done quite well in a few of years. That’s based on how things have been going in the past. Here we have the investor’s cost basis, which brings us to crucial level two.

Furthermore, this is the number that the average Bitcoin investor got wrong, and it’s somewhat lower at 19,400. Another historical analysis confirms that now was a great moment to stock up.

Also, this is not as frequently broken as the 200-week moving average, as evidenced by the COVID fall. Therefore, I believe this to be an outlier.

Since 2014, then, we have only one and a half examples. Again, this is just my opinion, but I think you’ll do quite well if your dollar cost averaging is less than this. The second crucial level has been described, and now we’ll return to this section to discuss the third crucial level.

The cost of a bitcoin is available. It draws attention to this insane expansion in 2021 and subsequent collapse in 2022. Our current price represents the last bull market cycle’s peak. In this case, the sum was 19,895.

Consequently, you can see that the crypto market is currently fluctuating between not one, not two, but three crucial levels of support.

So, the subsequent weeks and months will be really exciting. Then, as I’d promised, I revealed that long-term Bitcoin holders — defined here as those who have kept their coins for more than five months, a rather short period in the grand scheme of things — are experiencing some surprising developments.

However, our investors saw it this way. It’s important to keep an eye on the long-term holders here, as they seem to be the ones making the proper decisions. Let’s continue from where we left off. The cost of one bitcoin is shown in blue below.

Now is the time when prices are climbing, falling, and soaring again. While this price was rising, long-term investors began selling to cash in on their gains.

Then, as the price of Bitcoin dropped, they started to stock up and build their reserve. And they were just putting up holding buildings before this crypto winter hit. Then, as crypto prices started going back up, they started selling at the highest point in the market to make the most money.

Then, as the price of Bitcoin started to fall again, people started saving again. This is an excellent model to follow. We’re about to experience the final crash. Quite a bit of lateral motion is occurring here. Intriguingly, they sold at the same time as the final flush out.

This is a really neat little coda. However, this is the way to play the market in general, especially because the price is rising so rapidly. Make sure you make a profit but don’t go crazy. With the market tumbling, though, comes a great opportunity to stock up.

As we saw, long-term holders are the ones to keep an eye on; they are the ones to sell during major bull runs and the ones to accumulate during major crashes.

Current Developments

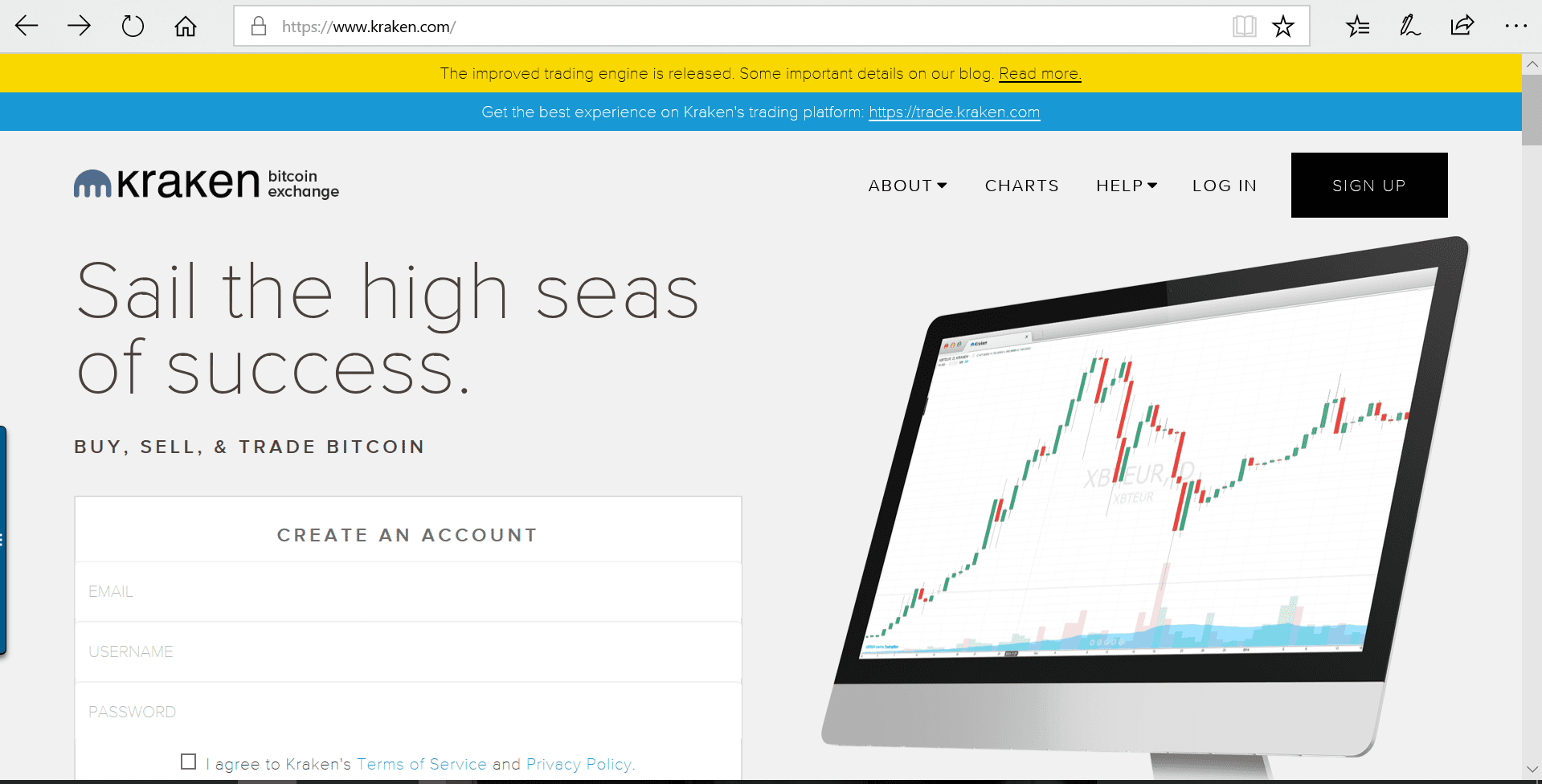

Currently, the crypto market is squaring off around three major levels of support: $22,000 (the 200-week moving average), $19,000 (the market cost basis), and $20,000 (the last major bull market top). Finally, in less than a week, one of the most momentous events in Kryptos’s history will take place. Confluence has become the center of attention.

Ark Invest’s graphic depicting the spread between Ethereum and Bitcoin trades. That’s a theory with a Bitcoin price tag rather than one with a dollar sign attached to it. This is the range of prices that we’re highlighting. For the period beginning in January 2021, an upward trend indicates that Ethereum is gaining ground on bitcoin, while a downward trend indicates that bitcoin is performing better.

Coincident with the market crisis, the value of Ethereum fell about Bitcoin. So Bitcoin was doing better than other currencies, but now that the unification is near, Lots of people are talking about how Ethereum will beat Bitcoin in bull markets but underperform it in bad markets, and this has sparked a lot of speculation.

A better chart to illustrate this would look like this one, although this goes against the trend because Ethereum is making gains in a declining market. We’re only looking at the last three months here, but you can already see the buildup to the integration in the price of Ethereum relative to Bitcoin. As interest in cryptocurrencies grows, Ethereum is quickly overtaking Bitcoin.

Photo by Kanchanara on Unsplash

As you can see, things are getting heated. Plus, the futures and options market is experiencing a peculiar trend. The open interest in the eath options market is depicted in green. How many people, roughly speaking, have been taking out options contracts recently? This is a 3x increase. That has led to widespread speculation about what the merger would entail.

Using borrowed money to buy a futures contract, the futures market has entered backwardation. Futures are merely agreements to buy and sell at a certain future price made between two parties. To put it simply, backwardation occurs when the present price is higher than the future price at which it is trading.

As a result, fascinating speculative trading practices and the futures and options market have emerged on the wager that it will truly be declining. So, taking everything into account, Cathie is still hopeful that inflation will soon be turning into deflation.

Ethereum is gaining momentum on Bitcoin as the merging nears, but there have been three times as many option contracts are taken out, and the futures market is now in backwardation.

The 200-week moving average, the investor cost basis, and the prior all-time high are all being tested. As a result, significant swings in the following weeks are to be anticipated. And with that, gentlemen, I present to you. Right now, the investment market is fraught with a great deal of uncertainty. However, this is also when some of the best chances can be taken.

As a result, savvy investors will have amassed no investment advice by the time the winter is through and prices start to soar again. To sum up, if you found the article to be even somewhat interesting, I’d greatly appreciate it if you’d click the “like” button below; otherwise, I’ll see you in the next installment.