The bear market has arrived. Can’t you tell? There’s blood on the streets and fear in the air. Panic selling is flooding the order books and red numbers dance across the board.

Bear markets are painful, we know. But they all also provide great opportunities that could change your life. With proper risk management and a cold mind, you can take advantage of them.

Here are some tips to survive the bear market and even use it in your favor.

Please note that this is an informative and educational article and not financial advice. Cryptocurrencies are very risky assets and you need to make sure you understand the implications of investing in them beforehand. Also, it contains referral links!

Dollar-cost average in BTC

Remember when bitcoin hit the $69,000 all-time high and you kept looking at the charts, wishing you had bought lower? Destiny has given you a second chance.

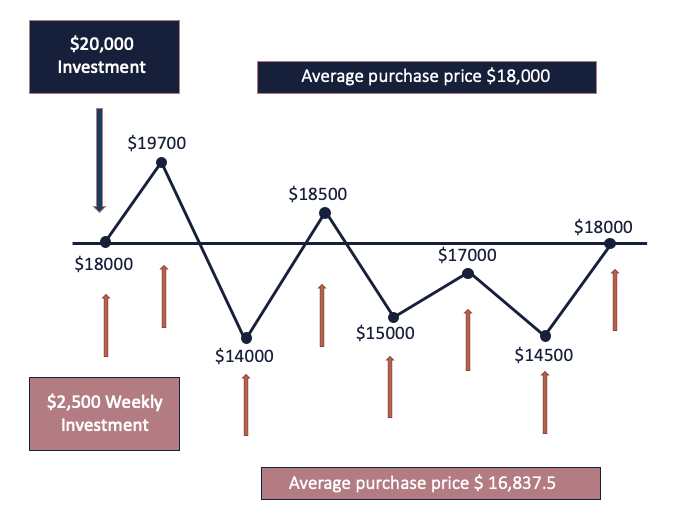

However, trying to catch falling knives is not a very good idea. You never know how low it can go. That’s why dollar-cost averaging (DCA) is a better alternative.

Just break up your budget into several parts and, instead of doing a single, large buy, do multiple, regular interval purchases every week or month. This system is great to lower your price average and maximize gains once the bull market resumes.

These are my two favorite exchanges to DCA into BTC:

1. Binance: Largest CEX in crypto. Best user experience, liquidity, and trading pairs. Requires KYC.

2. KuCoin: Good alternative to Binance that doesn’t require KYC verification.

Earn a passive income from stablecoin lending

Despite what happened with UST, other popular stablecoins have weathered the storm well. USDC, BUSD, and DAI all remained pegged to the dollar.

For its part, USDT briefly dipped below $1, but quickly recovered after handling a whooping $10B in withdrawals.

All these stablecoins have shown resiliency in holding their peg when tested, positioning themselves as a hedge against market volatility and falling prices.

That said, depositing these tokens on lending platforms is an effective way to generate yield without having to trade during a bear market.

Depending on your preferences, you can use centralized platforms or decentralized protocols to earn passive income in stablecoins while you wait for the next bull run.

Centralized platforms tend to offer higher yields, but they keep custody and hold the private keys to your coins.

My favorite centralized platforms for passive income in stablecoins are:

1. Nexo

2. BlockFi

3. KuCoin

Scalp and swing trading (high risk!)

Scalp trading — or simply scalping — is a strategy that consists of trading an asset in tiny periods. The aim is to make profits in the short term without committing to holding any assets.

Sometimes, scalp traders would open and close positions in less than a minute.

Swing trading, on the other hand, implies longer periods — usually a few days or weeks. The goal of swing trading is to capture a chunk of a potential price move.

Swing traders try to identify where an asset’s price is likely to move next, enter a long/short position, and capture a chunk of the profit if that move materializes.

During bear markets, crypto prices tend to range between two levels for several weeks, touching both sides of the range many times. Those moments provide unique opportunities for traders to open long or short positions for massive short-term profits.