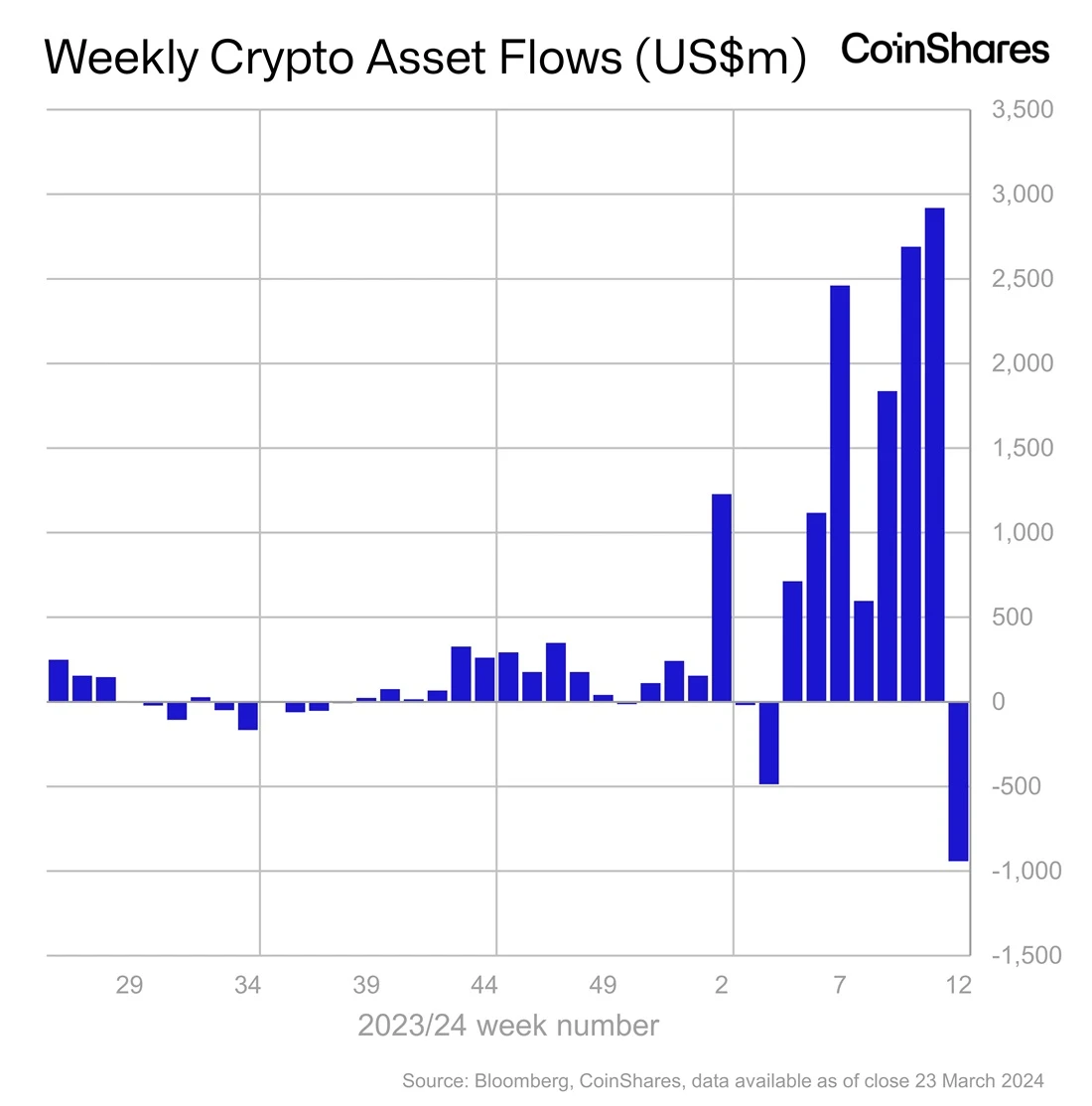

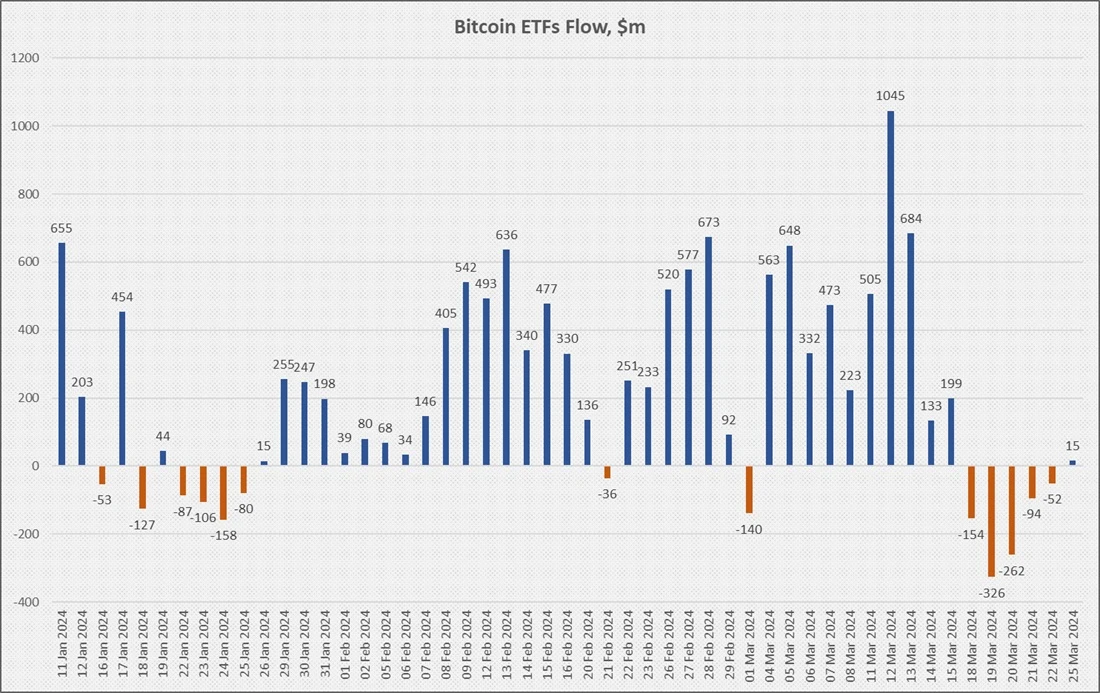

Last week witnessed a significant milestone as the volume of accumulated Bitcoin soared to unprecedented heights. Notably, a staggering net outflow of $942 million from ETFs was recorded, with Bitcoin comprising a whopping 96% of these funds. Analysts at JPMorgan cautioned investors about Bitcoin’s overbought status, signaling potential risks of a continued correction in a note to investors on March 21.

Image source: coinshares.com

Investor sentiment swiftly shifted as March unfolded, with a notable desire among long-term holders, whales, and miners to capitalize on profits following Bitcoin’s surge to a new record high.

Image source: StormGain Cryptocurrency Exchange

However, the landscape quickly evolved, with cryptocurrency exchanges witnessing a surge in coin withdrawals to cold wallets by the end of the week. This shift underscores market participants’ reluctance to part ways with their holdings at current price levels.

Coinbase, in particular, experienced a pronounced outflow in March, depleting the exchange’s reserves to 344,900 BTC – a level last observed in 2015. Concurrently, total reserves across all crypto exchanges declined after an earlier uptick, now standing at 1.98 million BTC.

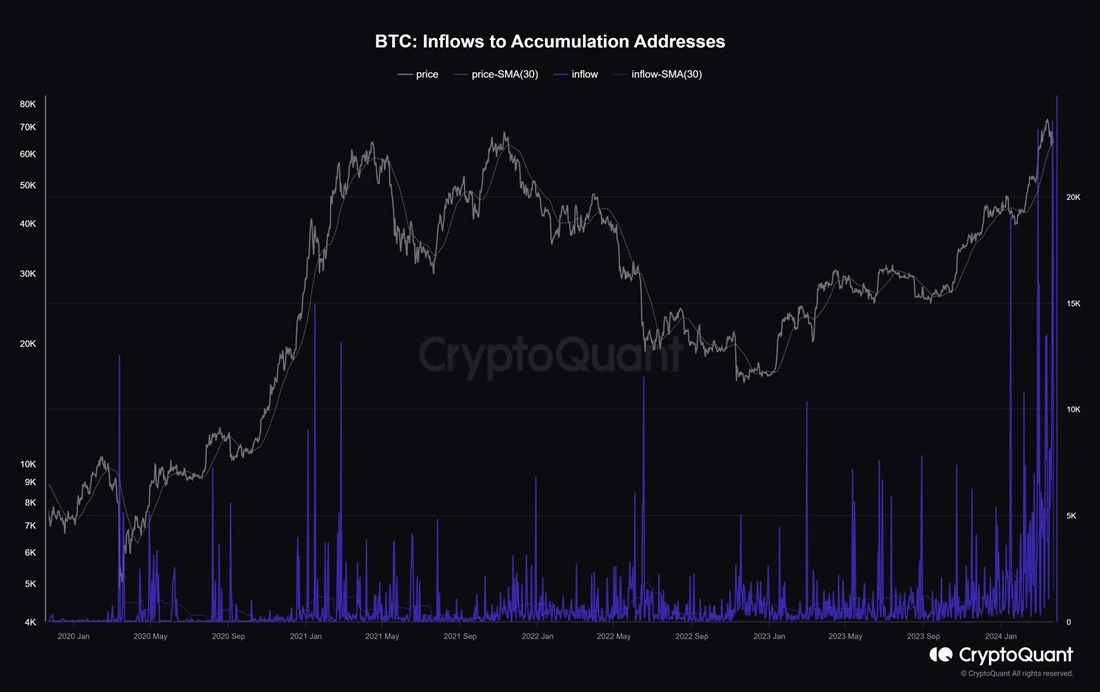

Image source: cryptoquant.com

A clear inclination towards hodling emerged, notably evidenced by accumulation addresses setting an inflow record of 25,300 BTC on March 22. Criteria for identification include the absence of outgoing transactions, multiple incoming transactions, recent activity within the past seven years, and a balance exceeding 10 BTC.

Image source: cryptoquant.com

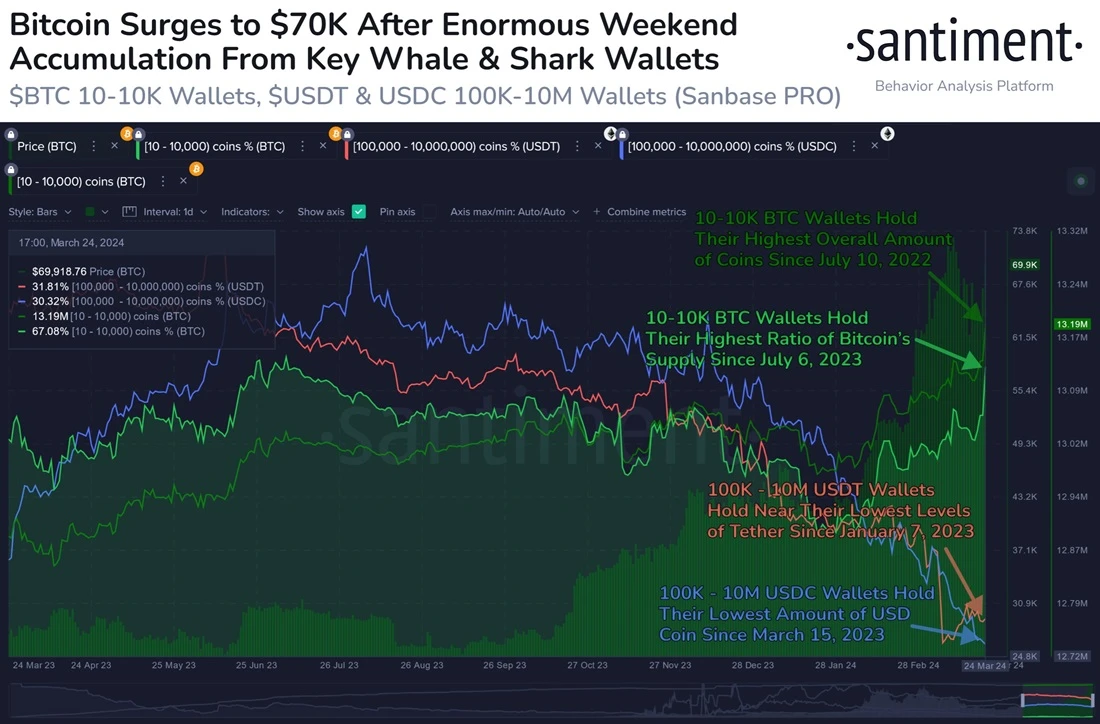

Further analysis reveals that whales and sharks have resumed accumulating Bitcoin, contributing significantly to the decline in stablecoin reserves.

Image source: twitter.com/santimentfeed

While BTC’s price surge in February was fueled by notable inflows into spot ETFs, this momentum waned by mid-March. Nevertheless, the absence of a significant sell-off indicates a swift transition among market participants from profit-taking to accumulation strategies.

Image source: StormGain infographic