Bitcoin will likely experience a breakdown from the current level, according to a recent analysis.

- Assessing the chances of a return of strong sell pressure based on Bitcoin’s bearish pennant pattern.

- Directional uncertainty still plagues Bitcoin as volumes remain low.

If you own Bitcoin [BTC], chances are that you have been waiting eagerly for the price to exit the current 2-week stalemate. A recent analysis may offer insights into which side BTC is likely to choose once it regains volatility.

A 24 May CryptoQuant analysis highlighted a good reason why Bitcoin will likely experience a breakdown from the current level. According to the analysis, the cryptocurrency is currently forming a bearish pennant pattern which is usually associated with downside.

The assessment also suggested that the derivatives market was already moving in a manner suggesting bearish expectations. The ratio of shorts versus longs in the last 24 hours showed that 51.75% of traders went short while 48.25% went long.

A look at Bitcoin data that may back these bearish expectations

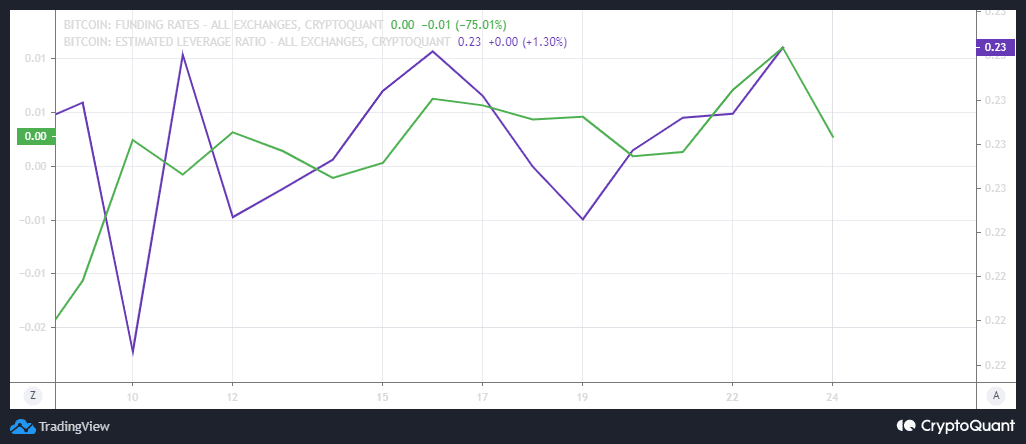

On-chain data also showed a pivot in Bitcoin’s estimated leverage ratio in the last 24 hours after previously registering significant upside.

On the other hand, funding rates in the derivatives market have been on the rise, suggesting that traders have been positioning themselves for a possible large move.

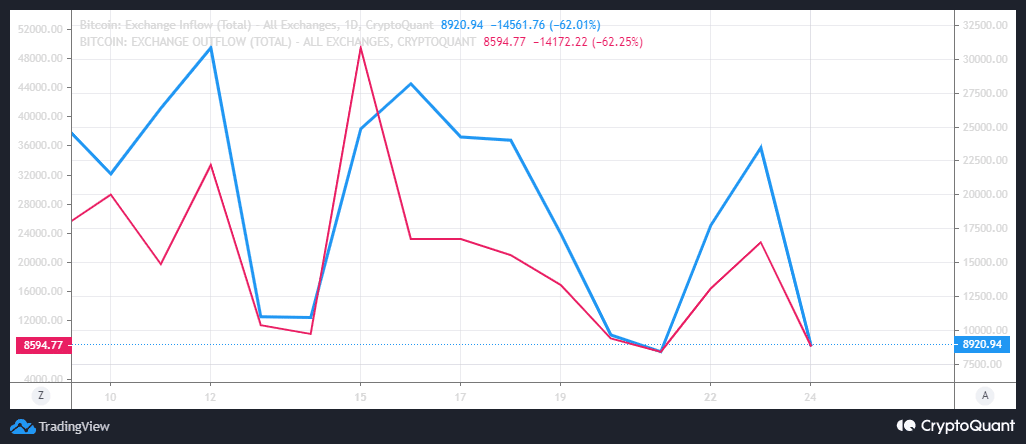

The bearish expectations are also evident in Bitcoin exchange flows. We did see a surge in exchange inflows since 21 May, with those inflows outweighing the exchange outflows.

This confirmed the surge in bearish expectations. Traders should note that the rate of flows has slowed down since then, but Bitcoin exchange inflows are still dominant over the outflows.

These findings indicate that more traders are adopting bearish expectations which may consequently trigger such an outcome. While the current bearish pennant price pattern suggests a high probability of such an outcome, it might not necessarily be the case.

Bitcoin investors should still move cautiously because a large amount of leveraged short positions may entice whales to buy.

Such an outcome would lead to higher price levels contrary to expectations, and consequently a lot of shorts being liquidated. This would in turn force short sellers to reaccumulate BTC, thus contributing to a new wave of buy pressure.

Note that these scenarios are currently still within the realm of speculation. This is because Bitcoin’s current level of buy and sell pressure is still low.

This means it might still be too soon to make an accurate assessment regarding the next major BTC price move in the short run. Nevertheless, the ranging performance is now overextended and a breakout/breakdown might be due at any time.